Retention Of Risk Definition In Insurance . retention is the amount of risk that you, as the policyholder, agree to retain or bear, while the rest is transferred to the insurer. retention in insurance specifies the portion of potential damages policyholders must cover. risk retention definition reflects the intentional acceptance of losses and covering them out of pocket instead of transferring the financial. risk retention in insurance is a strategic choice where you, as a business owner, personally shoulder the financial risk of. risk retention is an individual or organization’s decision to take responsibility for a particular risk it faces,. risk retention is a risk management strategy that can be used to manage and reduce the financial impact of certain risks. Retention refers to the process of managing risk by consciously choosing to accept the potential financial. Retention differs from deductibles, with the.

from www.slideserve.com

risk retention is a risk management strategy that can be used to manage and reduce the financial impact of certain risks. Retention refers to the process of managing risk by consciously choosing to accept the potential financial. retention in insurance specifies the portion of potential damages policyholders must cover. risk retention is an individual or organization’s decision to take responsibility for a particular risk it faces,. risk retention definition reflects the intentional acceptance of losses and covering them out of pocket instead of transferring the financial. retention is the amount of risk that you, as the policyholder, agree to retain or bear, while the rest is transferred to the insurer. risk retention in insurance is a strategic choice where you, as a business owner, personally shoulder the financial risk of. Retention differs from deductibles, with the.

PPT Captive Insurance Risk & Financial Implications PowerPoint Presentation ID6792875

Retention Of Risk Definition In Insurance risk retention in insurance is a strategic choice where you, as a business owner, personally shoulder the financial risk of. Retention differs from deductibles, with the. risk retention is a risk management strategy that can be used to manage and reduce the financial impact of certain risks. retention in insurance specifies the portion of potential damages policyholders must cover. risk retention in insurance is a strategic choice where you, as a business owner, personally shoulder the financial risk of. Retention refers to the process of managing risk by consciously choosing to accept the potential financial. risk retention is an individual or organization’s decision to take responsibility for a particular risk it faces,. risk retention definition reflects the intentional acceptance of losses and covering them out of pocket instead of transferring the financial. retention is the amount of risk that you, as the policyholder, agree to retain or bear, while the rest is transferred to the insurer.

From www.slideserve.com

PPT PBBF 303 FIN. RISK MANAGEMENT AND INSURANCE LECTURE THREE INTRODUCTION TO RISK MANAGEMENT Retention Of Risk Definition In Insurance risk retention is a risk management strategy that can be used to manage and reduce the financial impact of certain risks. risk retention definition reflects the intentional acceptance of losses and covering them out of pocket instead of transferring the financial. Retention refers to the process of managing risk by consciously choosing to accept the potential financial. Retention. Retention Of Risk Definition In Insurance.

From www.superfastcpa.com

What is Risk Retention? Retention Of Risk Definition In Insurance risk retention is a risk management strategy that can be used to manage and reduce the financial impact of certain risks. Retention differs from deductibles, with the. risk retention definition reflects the intentional acceptance of losses and covering them out of pocket instead of transferring the financial. retention is the amount of risk that you, as the. Retention Of Risk Definition In Insurance.

From corporateguarantee.com

Our Approach Retention Of Risk Definition In Insurance risk retention is an individual or organization’s decision to take responsibility for a particular risk it faces,. retention is the amount of risk that you, as the policyholder, agree to retain or bear, while the rest is transferred to the insurer. Retention differs from deductibles, with the. risk retention definition reflects the intentional acceptance of losses and. Retention Of Risk Definition In Insurance.

From www.hertvik.com

Risk Retention Group Medina Hertvik Insurance Group Retention Of Risk Definition In Insurance retention is the amount of risk that you, as the policyholder, agree to retain or bear, while the rest is transferred to the insurer. retention in insurance specifies the portion of potential damages policyholders must cover. risk retention is a risk management strategy that can be used to manage and reduce the financial impact of certain risks.. Retention Of Risk Definition In Insurance.

From www.slideserve.com

PPT 2. Introduction to Risk Management PowerPoint Presentation, free download ID6769282 Retention Of Risk Definition In Insurance Retention differs from deductibles, with the. risk retention is a risk management strategy that can be used to manage and reduce the financial impact of certain risks. retention in insurance specifies the portion of potential damages policyholders must cover. retention is the amount of risk that you, as the policyholder, agree to retain or bear, while the. Retention Of Risk Definition In Insurance.

From www.investopedia.com

Risk Retention Group (RRG) Retention Of Risk Definition In Insurance risk retention definition reflects the intentional acceptance of losses and covering them out of pocket instead of transferring the financial. Retention differs from deductibles, with the. retention is the amount of risk that you, as the policyholder, agree to retain or bear, while the rest is transferred to the insurer. risk retention is a risk management strategy. Retention Of Risk Definition In Insurance.

From www.slideserve.com

PPT Risk Management PowerPoint Presentation, free download ID1676626 Retention Of Risk Definition In Insurance Retention refers to the process of managing risk by consciously choosing to accept the potential financial. retention is the amount of risk that you, as the policyholder, agree to retain or bear, while the rest is transferred to the insurer. risk retention definition reflects the intentional acceptance of losses and covering them out of pocket instead of transferring. Retention Of Risk Definition In Insurance.

From www.youtube.com

What is Risk Retention in Insurance? Meaning Of Risk Retention in Insurance Dr. Sahil Roy Retention Of Risk Definition In Insurance risk retention is a risk management strategy that can be used to manage and reduce the financial impact of certain risks. retention is the amount of risk that you, as the policyholder, agree to retain or bear, while the rest is transferred to the insurer. risk retention is an individual or organization’s decision to take responsibility for. Retention Of Risk Definition In Insurance.

From www.slideserve.com

PPT Unit 4 PowerPoint Presentation, free download ID3542438 Retention Of Risk Definition In Insurance risk retention in insurance is a strategic choice where you, as a business owner, personally shoulder the financial risk of. risk retention definition reflects the intentional acceptance of losses and covering them out of pocket instead of transferring the financial. retention is the amount of risk that you, as the policyholder, agree to retain or bear, while. Retention Of Risk Definition In Insurance.

From www.awesomefintech.com

Complete Retention AwesomeFinTech Blog Retention Of Risk Definition In Insurance risk retention is a risk management strategy that can be used to manage and reduce the financial impact of certain risks. retention is the amount of risk that you, as the policyholder, agree to retain or bear, while the rest is transferred to the insurer. retention in insurance specifies the portion of potential damages policyholders must cover.. Retention Of Risk Definition In Insurance.

From www.dreamstime.com

Risk retention line icon stock vector. Illustration of financial 233109396 Retention Of Risk Definition In Insurance Retention refers to the process of managing risk by consciously choosing to accept the potential financial. risk retention definition reflects the intentional acceptance of losses and covering them out of pocket instead of transferring the financial. Retention differs from deductibles, with the. retention is the amount of risk that you, as the policyholder, agree to retain or bear,. Retention Of Risk Definition In Insurance.

From www.dechert.com

Risk Retention Retention Of Risk Definition In Insurance Retention refers to the process of managing risk by consciously choosing to accept the potential financial. Retention differs from deductibles, with the. retention is the amount of risk that you, as the policyholder, agree to retain or bear, while the rest is transferred to the insurer. risk retention is a risk management strategy that can be used to. Retention Of Risk Definition In Insurance.

From www.slideserve.com

PPT RISK MANAGEMENT & INSURANCE PowerPoint Presentation, free download ID5510727 Retention Of Risk Definition In Insurance retention is the amount of risk that you, as the policyholder, agree to retain or bear, while the rest is transferred to the insurer. Retention differs from deductibles, with the. risk retention definition reflects the intentional acceptance of losses and covering them out of pocket instead of transferring the financial. retention in insurance specifies the portion of. Retention Of Risk Definition In Insurance.

From www.slideshare.net

Risk management Retention Of Risk Definition In Insurance risk retention in insurance is a strategic choice where you, as a business owner, personally shoulder the financial risk of. risk retention definition reflects the intentional acceptance of losses and covering them out of pocket instead of transferring the financial. risk retention is an individual or organization’s decision to take responsibility for a particular risk it faces,.. Retention Of Risk Definition In Insurance.

From www.slideserve.com

PPT Captives 301 PowerPoint Presentation, free download ID799174 Retention Of Risk Definition In Insurance risk retention in insurance is a strategic choice where you, as a business owner, personally shoulder the financial risk of. Retention differs from deductibles, with the. risk retention is a risk management strategy that can be used to manage and reduce the financial impact of certain risks. retention in insurance specifies the portion of potential damages policyholders. Retention Of Risk Definition In Insurance.

From www.slideserve.com

PPT 2. Introduction to Risk Management PowerPoint Presentation, free download ID6769282 Retention Of Risk Definition In Insurance risk retention is an individual or organization’s decision to take responsibility for a particular risk it faces,. Retention differs from deductibles, with the. Retention refers to the process of managing risk by consciously choosing to accept the potential financial. risk retention definition reflects the intentional acceptance of losses and covering them out of pocket instead of transferring the. Retention Of Risk Definition In Insurance.

From www.slideserve.com

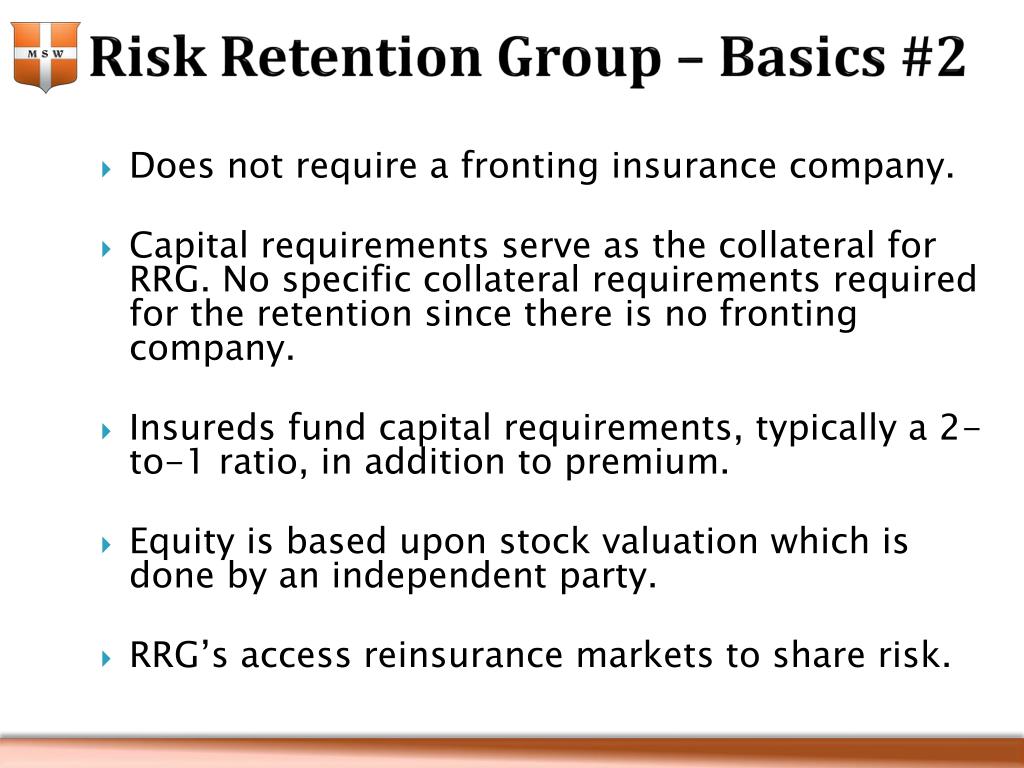

PPT Risk Retention Group PowerPoint Presentation, free download ID4217978 Retention Of Risk Definition In Insurance retention is the amount of risk that you, as the policyholder, agree to retain or bear, while the rest is transferred to the insurer. risk retention in insurance is a strategic choice where you, as a business owner, personally shoulder the financial risk of. risk retention definition reflects the intentional acceptance of losses and covering them out. Retention Of Risk Definition In Insurance.

From www.investopedia.com

Risk Retention Group (RRG) Meaning, Benefits, History Retention Of Risk Definition In Insurance Retention refers to the process of managing risk by consciously choosing to accept the potential financial. risk retention in insurance is a strategic choice where you, as a business owner, personally shoulder the financial risk of. retention is the amount of risk that you, as the policyholder, agree to retain or bear, while the rest is transferred to. Retention Of Risk Definition In Insurance.